portability estate tax return

Ad Access Tax Forms. Through a portability election to port the DSUE on a timely filed Estate Tax Return or an Estate Tax Return filed late consistent with the terms of Revenue Procedure 2022-32 the.

Fillable Form 1040 2017 Income Tax Return Income Tax Tax Return

2017-34 this simplified method which is used in lieu of the letter.

. For purposes of filing a Portability Return only the IRS also established an automatic extension two years from the Decedents date of death. Ad As any other written will a self-proving will is subject to the same witness requirements. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within 270 days after her husbands death.

Ad File For Free With TurboTax Free Edition. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You will receive a confirmation email after you submit your request.

Import Your Tax Forms And File For Your Max Refund Today. You must adhere to the rules and regulations of the receiving PHA which may differ from the initial voucher issued by NYCHA. It includes one component that is not strictly required for NJ wills.

Estate tax return preparation services. We skillfully prepare estate tax returns for individuals and attorneys. Click on the Portability tab.

2010 c 5 A if that estate was not required by Sec. Assuming that Sally has not used any of her estate tax exemption for lifetime gifts. For example if Bob and Sally are married and Bob dies in 2011 and only uses 3000000 of his 5000000 federal estate tax exemption then Sally can elect to pick up Bobs unused 2000000 exemption and add it to her estate tax exemption.

2017-34 the IRS provided a simplified method for obtaining an extension of time under Regs. You may file for an automatic 6 month extension by filing IRS Form 4768. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706.

The election to transfer a DSUE amount to a surviving spouse is known as the portability election. Through a portability election to port the DSUE on a timely filed Estate Tax Return or an Estate Tax Return filed late consistent with the. 6018 a to file an estate tax return.

The non-exempted amount of 545 million would be portable and would be passed to his wife. 2 If the Estate did not file within that two. To allow a decedents surviving spouse to take into account that decedents deceased spousal unused exclusion DSUE amount the executor of the decedents estate must elect portability of the DSUE amount on a timely filed Form 706 United States Estate and Generation-Skipping Transfer Tax Return estate tax return.

Complete Edit or Print Tax Forms Instantly. Call us now at 732-777-1158 or request a consultation to learn more. Since in 2015 the federal estate tax exemption is 543 million per person the exemption changes every year since it is indexed for.

A Election required for portability. Please note these laws being permanent means that they are not set. Income tax returns for individuals.

If the portability election is filed in time the entire estate of 60 million will be named under the wife. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. The Estate Tax Return is due nine months from the Decedents date of death.

To claim estate tax portability the estate tax representative must file an estate tax return within 9 months of the first spouses death. Time To Finish Up Your Taxes. 3019100-3 to make a portability election under Sec.

Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion DSUE amount to a surviving spouse regardless of the size of the gross estate or amount of adjusted taxable gifts. Complete and submit the online Request for Portability.

So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can. If the estate needs more time to file for portability they can apply for a 6-month extension. 2 days agoBefore this enactment of estate tax exemption portability the unused estate tax exemption of the first spouse to die was a use it or lose it proposition.

To secure these benefits however the deceased spouses executor must have made a portability election on a timely filed estate tax return Form 706. However the exemption is scheduled to drop to 1 million after 2012 unless Congress intervenes. When filing the taxes its important to select the portability election to have the benefits transferred to.

In 2012 inflation adjustments increased the exemption to 5120000. Under Section 2010c5A of the Internal Revenue Code the Code the estate of a decedent who died survived by a spouse after December 31 2010 which is not otherwise required to file a Form 706 United States and Generation-Skipping Transfer Tax Return may make a portability election allowing such decedents federal. See If You Qualify and File Today.

Find out how working with our Edison NJ CPA firm can take the pain out of tax time. You can check and review your status anytime online. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 exempts from federal estate tax the first 5 million of a decedents taxable estate.

The portability election refers to the right of a surviving spouse to claim the unused portion of the federal estate tax exemption of their deceased spouse and add it to the balance of their own exemption.

Postmortem Tax Planning Ppt Download

Sample Corporate Tax Return Letter Template

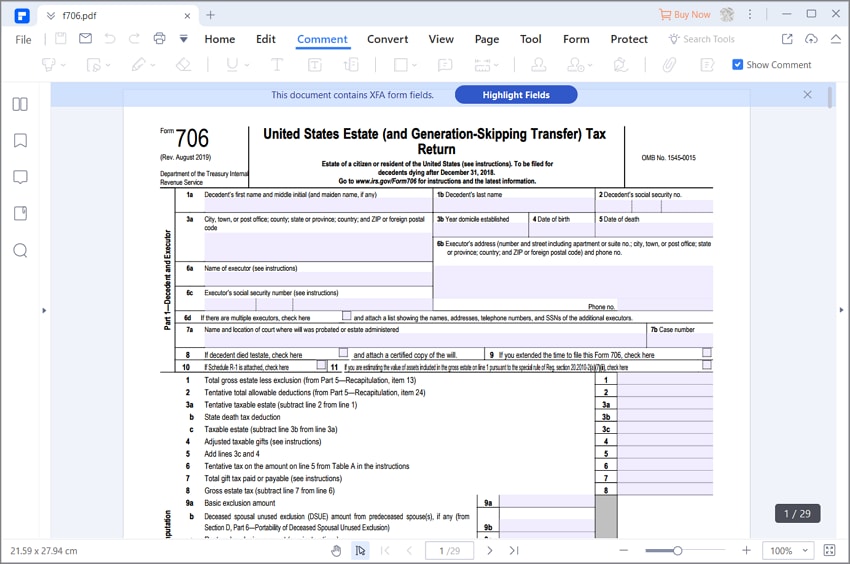

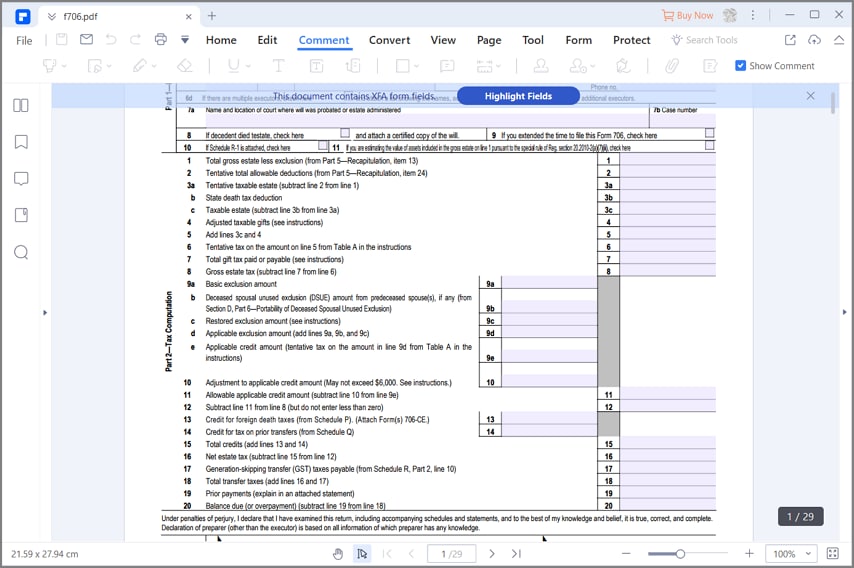

Form 706 Preparation Overview 1 Youtube

Postmortem Tax Planning Ppt Download

Tips For Filing Taxes When Married Rings Married Married Couple

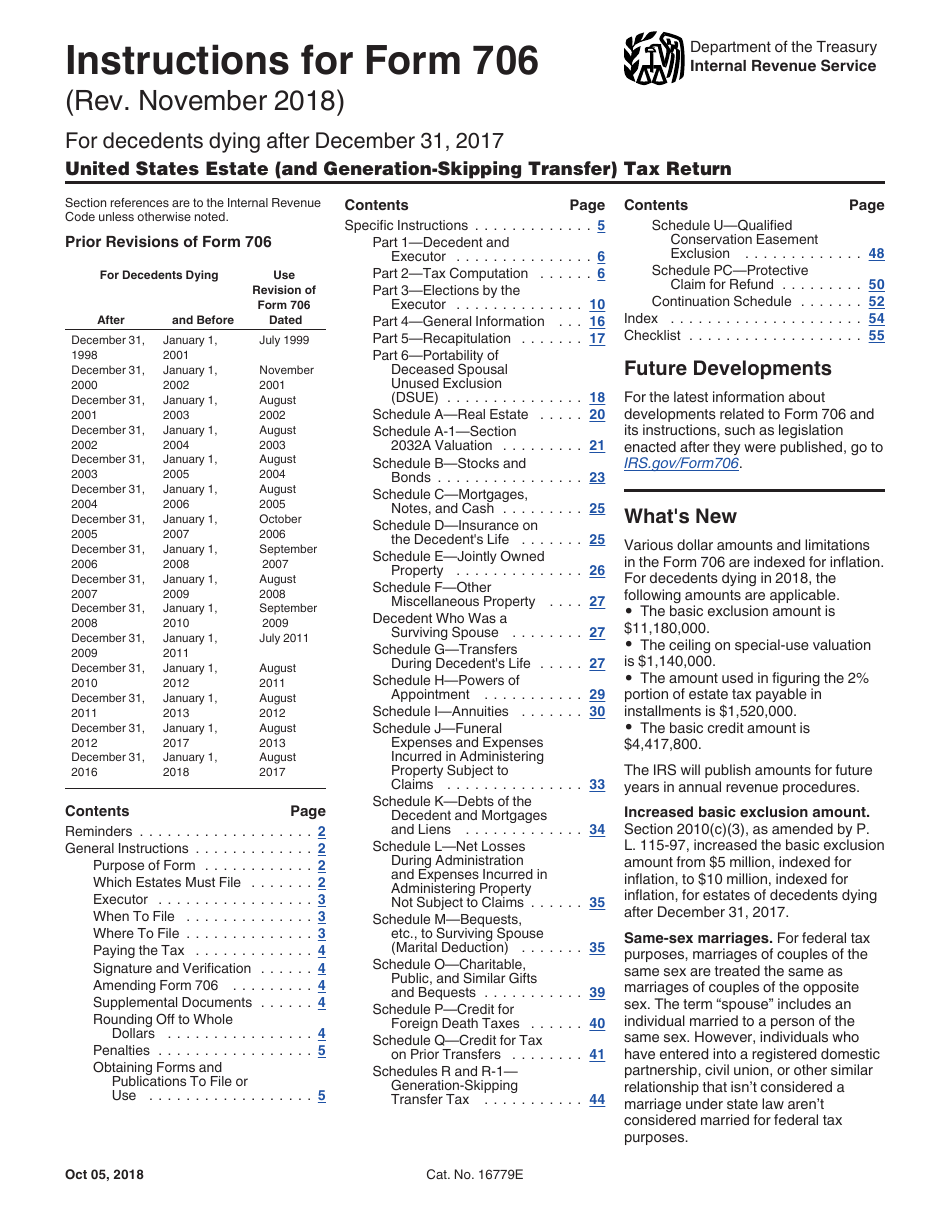

Download Instructions For Irs Form 706 United States Estate And Generation Skipping Transfer Tax Return Pdf Templateroller

Form 706 Preparation Overview 1 Youtube

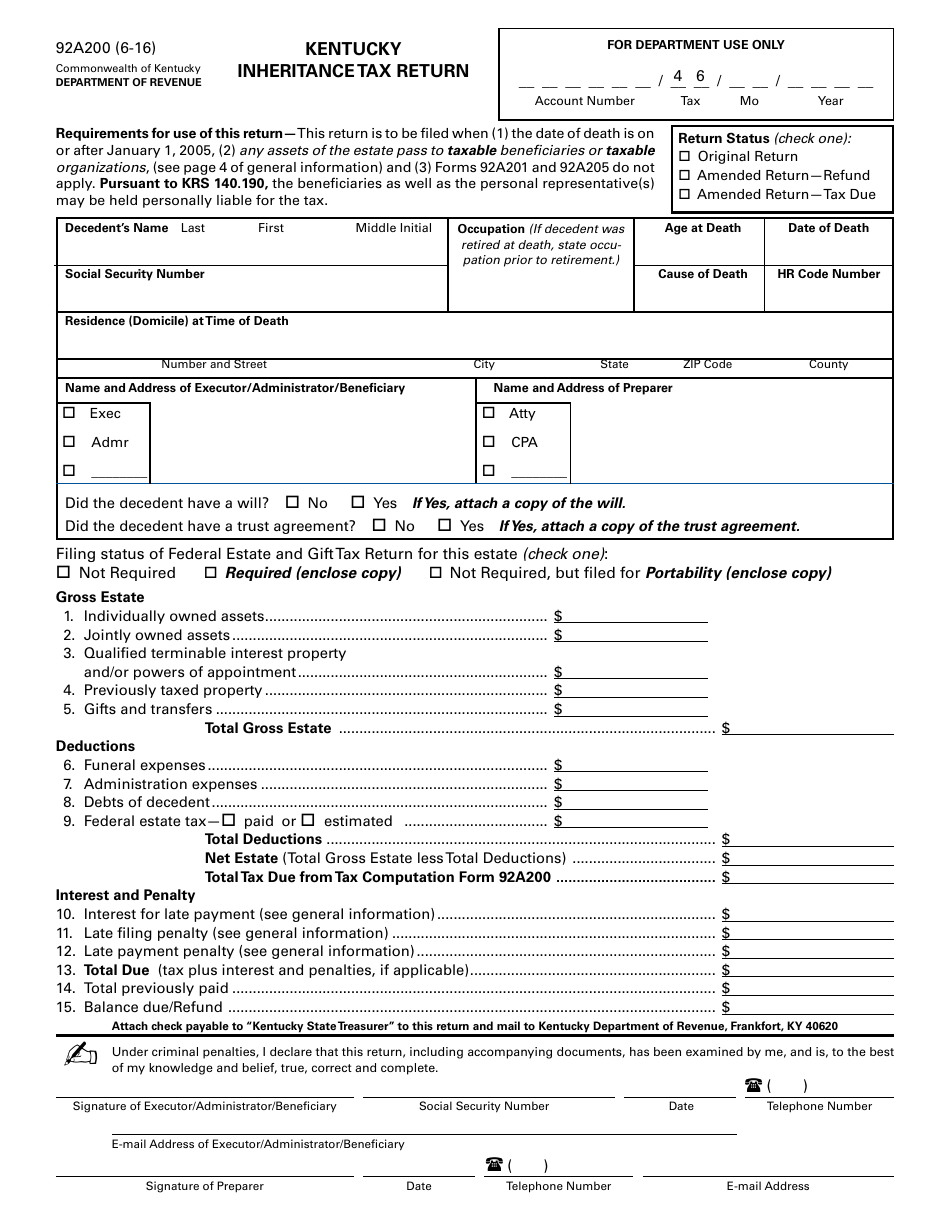

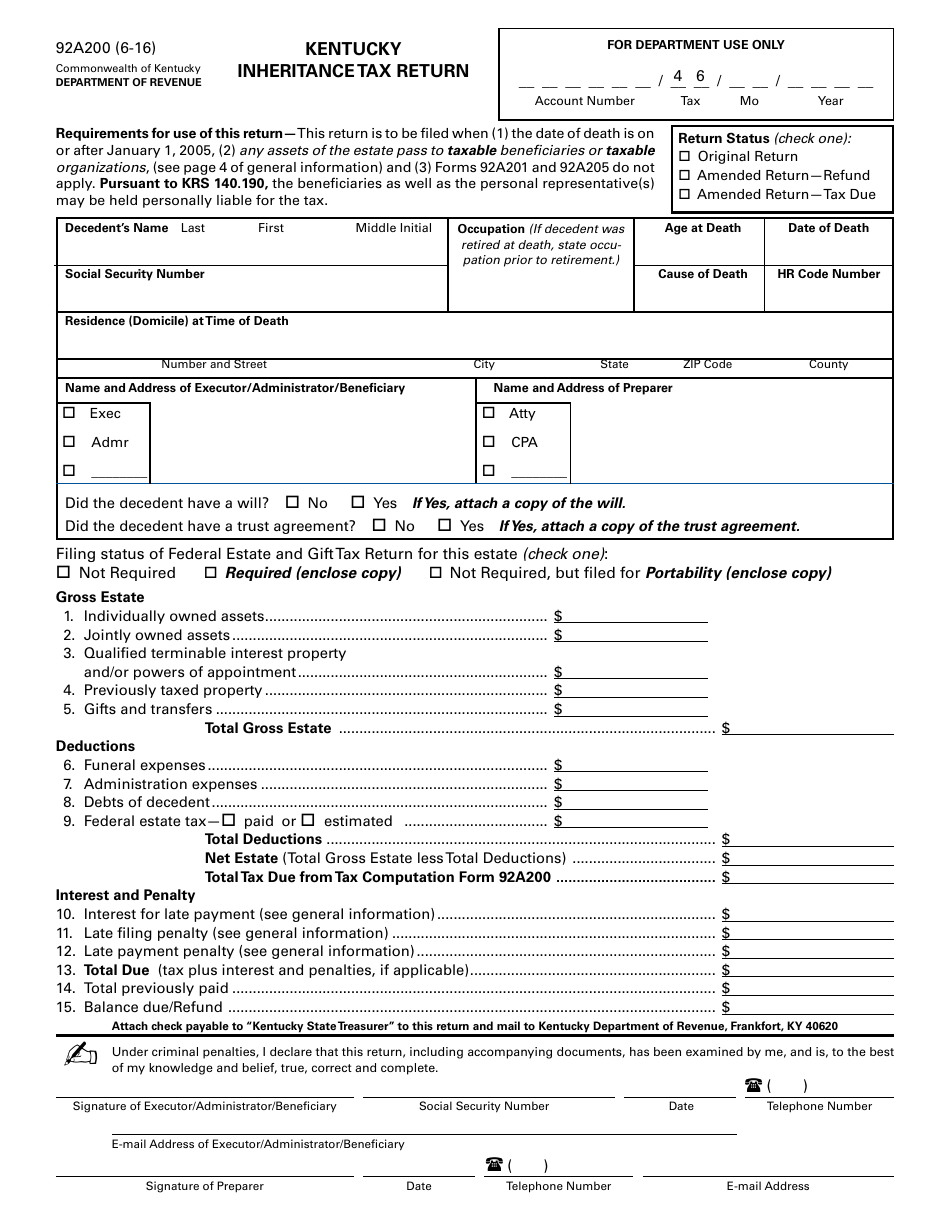

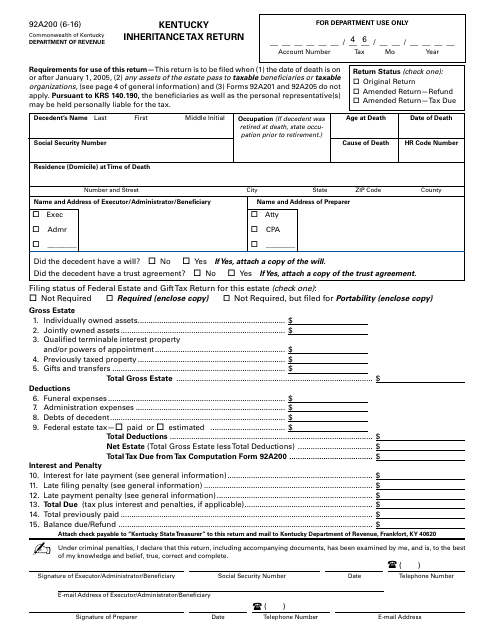

Form 92a200 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return Kentucky Templateroller

Irs Releases Form 8971 Law Office Of Kevin A Pollock Llc

For How To Fill In Irs Form 706

Postmortem Tax Planning Ppt Download

Form 92a200 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return Kentucky Templateroller

For How To Fill In Irs Form 706